The American Diabetes Association in conjunction with the Georgetown University Health Policy Institute announced the results of a 14-month study examining barriers to accessible, affordable and adequate health insurance for Americans with diabetes.

Entitled "Falling Through the Cracks, Stories of How Health Insurance can Fail People with Diabetes," and funded by the Commonwealth Fund, Robert Wood Johnson Foundation and W.K. Kellogg Foundation, the study of 851 people from across the United States identifies barriers in all components of the private health insurance system that can prevent Americans with diabetes from properly managing the disease.

Common problems highlighted by the report document serious flaws in the private and publicly financed health insurance system in America. These flaws include health insurance policies that did not cover basic diabetes needs; high risk pools with pre-existing condition exclusions that deterred people from enrolling; health insurance premium surcharges for diabetes that drove premiums above what individuals and small businesses could afford; medical underwriting practices that designated diabetes as "uninsurable;" Medicaid eligibility limits that left many low income people unable to access this safety net; cumbersome insurance processes that fail to help people navigate complex rules and deadlines; and application procedures that drove many to give up on seeking coverage altogether.

For example, the study documents the story of Janice Ramsey, of Deltona, Florida, who presented at the report's release. Mrs. Ramsey was a small business owner who was dropped by her individual policy once she was diagnosed with diabetes, left with $22,000 in debt by a fraudulent association health plan, and turned down by numerous other carriers. At age 60, she remains uninsured and worries she and her husband could lose everything if she gets seriously ill before she becomes eligible for Medicare.

"This study observed many instances in which having diabetes can make it harder to get and keep health insurance -- a profound irony given the purpose of health insurance is to protect people when they are sick," said Karen Pollitz, MPP, Project Director, Georgetown University Health Policy Institute. "People in transition following a job loss or change in family status often could not obtain new health coverage. Safety net options created to help in these circumstances often didn't work because the help they offer is incomplete. People with stable coverage also had problems when they were underinsured, lacking coverage for blood glucose test strips and prescriptions or burdened by high deductibles. The people we talked to needed coverage that was available, affordable and adequate. Two out of three just didn't work. Many people had trouble managing their diabetes, got sicker or went into debt as a result. The implications of these coverage problems for public health, costs to Medicare and Medicaid and the impact on the entire health system due to uncontrolled diabetes are enormous."

Continue Reading Below ↓↓↓

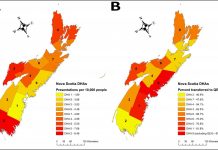

R. Stewart Perry, Chair, Advocacy Committee of the American Diabetes Association added, "This report shows that if you have diabetes in America, you are at serious risk every day of losing your ability to manage the disease due to a patchwork healthcare system that just doesn't fit together. And, most of the policy solutions currently being considered by our state and federal policy makers do little to fix the problems identified by the report. Given that as many as one in 10 Americans live with diabetes today in certain states and one in three Americans will have the disease by 2050, it is time for policymakers to seriously rethink the flawed health insurance solutions up for debate that harm as opposed to benefit people with diabetes."

The study adds to what are troubling trends related to diabetes in America. Already classified as an epidemic by the Centers for Disease Control and Prevention, diabetes continues to affect more and more families in America and it is growing 8% per year. Today, 6.3% of Americans live with the disease but by the year 2050 one in three will have the disease but as many as one in two minorities will live with diabetes. In 2002, one in ten healthcare dollars and one in four Medicare dollars went towards diabetes care. The cost of diabetes in America in 2002 was at least $132 billion. We can reverse these trends, but to do so, we need a health care system that allows diabetes patients to manage their care and that provides the tools to help reduce the number of Americans who will be diagnosed with the disease.

To obtain copies of "Falling Through the Cracks, Stories of How Health Insurance can Fail People with Diabetes," visit the American Diabetes Association or the Georgetown University Health Policy.

Source: American Diabetes Association